How do you file 1099-MISC

We’ve covered the information you need to collect before you can file a 1099-MISC in the past. Today we’re going to look at what you physically need to do in order to file a 1099-MISC.

If you head over to the IRS website, you will notice that the 1099-MISC form is actually five separate forms. That doesn’t mean it’s going to be five times the work. The five copies are all used for specific purposes, and each has a specific recipient that they are intended for.

Wait? Five copies? I’ve received 1099’s before but I never received five copies of them!

So, what are the different 1099-MISC copies for?

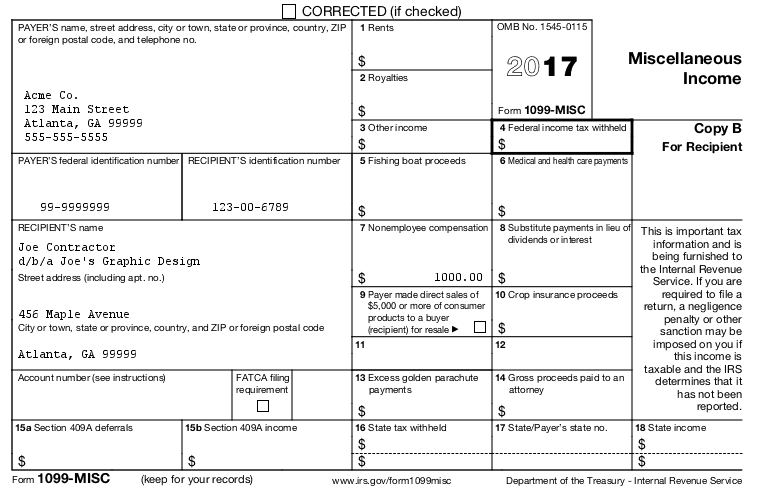

When you look at a 1099-MISC you will find which copy you are looking at in the far right column under the words “Miscellaneous Income”. The five copies are Copy A, Copy 1, Copy B, Copy 2, and Copy C. The IRS doesn’t jump between using letters and numbers (while forgetting all about Copy 3) just to confuse you. The lettered copies are intended for federal purposes. The numbered copies are intended for state purposes.

Copy A

The only copy printed in red is Copy A. This is the copy that the payer should send to the IRS. However, the copy you file has to be a special, scannable version that you can obtain from the IRS website. You can’t file the Copy A version that you download and print from the IRS website.

To order the scannable copies of 1099-MISC, visit https://www.irs.gov/orderforms. Then click on Employer and Information Returns and follow the instructions.

Copy 1

This is the copy that the payer should send to their state revenue department. Some states do not require that 1099-MISC forms are filed, while others require it under certain circumstances. You should check with your state revenue department to see if you need to file Copy 1.

Copy B

This copy is sent to your recipient or independent contractor. They will keep this copy for their records, and use it to assist in filing their taxes.

Copy 2

This copy is also sent to your recipient or independent contractor. They will file this with their state income tax return when required.

Copy C

This copy is for the payer’s records.

How do you file 1099-MISC

Officially, the IRS allows handwritten forms, but the handwriting must be completely legible and accurate. Often times, handwritten forms have errors in them. It is preferable to type the entries on the form.

Print using black ink in 12-point Courier font like in the example below.

Print the same information on each copy. When your recipient files their taxes they will include the information that you provide on the 1099-MISC. When the IRS receives the recipient’s tax return they will compare the amounts on Copy A that you filed with them to the recipient’s return. If there are any discrepancies it will trigger a red flag at the IRS and likely cause issues for your recipient and you.

The left-hand side is fairly self-explanatory. The payer is the business who made a payment during the year to the recipient listed on the 1099-MISC. You should have collected this information during the year, so it should be fairly easy to fill out.

The right-hand side is slightly more complicated because you need to break out payments into the correct category. View the Payment Information section on this post for more information on what amounts should go in which boxes.

When entering dollar amounts in the boxes:

- Do not use dollar signs ($). Dollar signs are pre-printed on the form in boxes that expect a dollar amount.

- Do not use commas (,). Enter 1000.00 instead of 1,000.00

- If there is no amount to report in a particular box, leave it empty. Do not enter things such as:

- —–

- ****

- 0.00

- 0

- #

- N/A

- Use decimals to enter the cents. 1234.56

Paper File or e-file?

You must e-File if you have 250 or more 1099-MISC to file. You can mail in printed copies if you have fewer than 250 to file.

Paper Filing

Order the paper version from the IRS by visiting https://www.irs.gov/orderforms. You will also need to complete form 1096 if you paper file. You can order that from the same website.

e-file

In order to e-file you need to obtain a Transmitter Control Code (TCC) from the IRS by filling out form 4419. Submit this form at least 45 days before the filing deadline.

Once you receive your TCC you can create an account on the IRS Filing Information Returns Electronically (FIRE) system. As the name suggests, this is where you will be able to file the returns electronically to the IRS. The FIRE system requires special software that creates the file you upload in the proper format.

If you e-file, you will still need to send Copies B and 2 to your contractors.